| 08 October 2024 | View in browser |

|---|---|

|

|---|

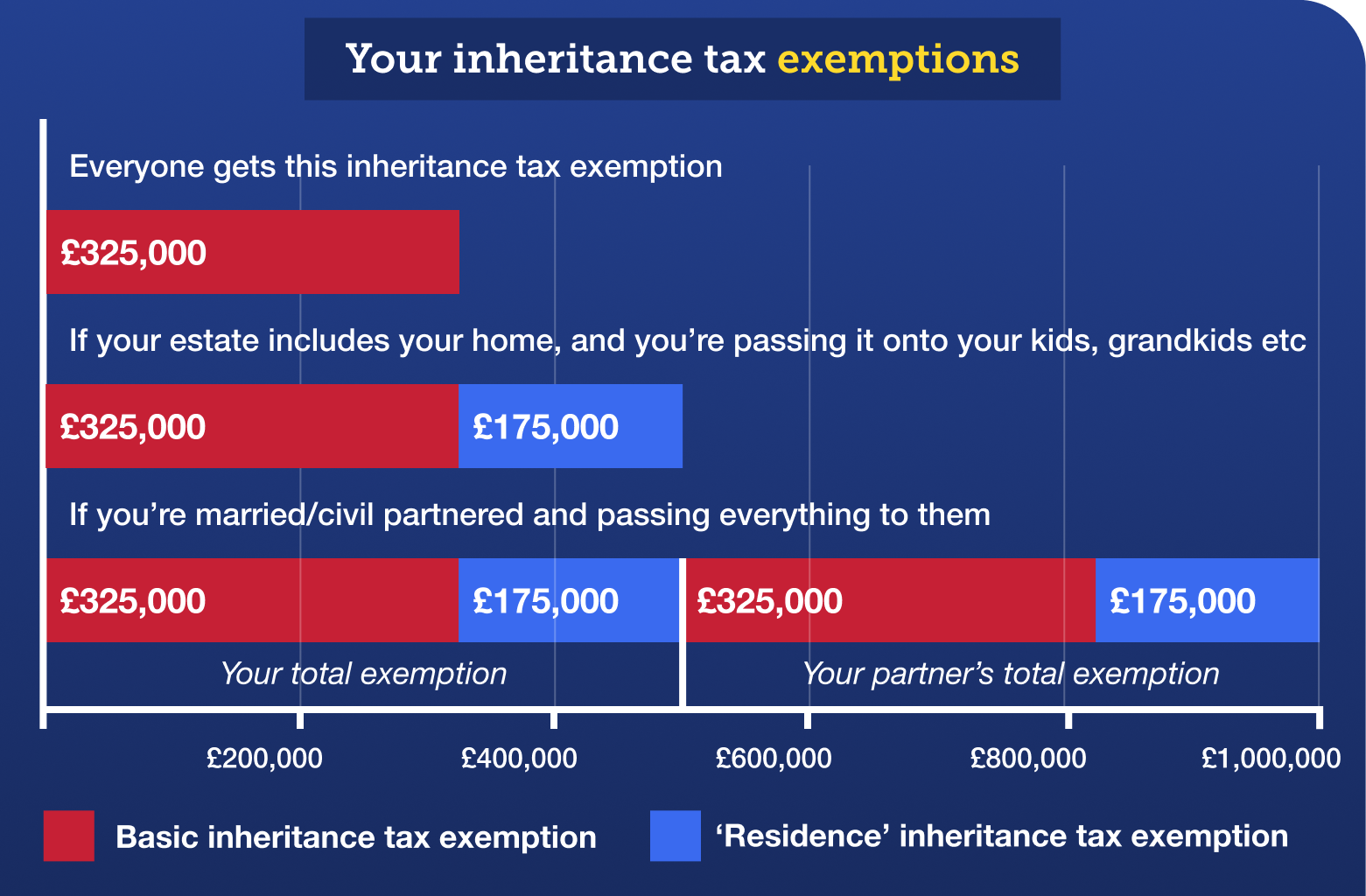

| Seven quick inheritance tax (IHT) need-knows   Lasting Power of Attorney (while not perfect) is one of the most important precautions. Lasting Power of Attorney (while not perfect) is one of the most important precautions. Yet do be aware plans often exclude things such as burial plots, headstones, flowers, embalming and wake costs, so there can be £100s or £1,000s more to be paid by loved ones. So you need to know exactly what's included in the funeral plan you're paying for. If that doesn't work, I'm afraid you'll have to individually contact the remaining authorised funeral plan providers listed on the Financial Conduct Authority register. |

|---|

|  |  |

|---|

| | ||

|---|---|---|

| (1) Virgin and NatWest have asked us to send people via eligibility, not direct. |

a) Never miss the minimum monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Aim to clear the card (or balance-transfer again) before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend or withdraw cash. It usually isn't at the cheap rate & withdrawals may hit your ability to access credit.

d) If you don't transfer at application, you've usually only 60 to 90 days to get the 0%. Do check your card's terms.

Q. Is it worth applying if my eligibility odds are low? | Q. What if my credit limit isn't big enough? | Q. Can I shift debt to existing cards too? | Q. Should I try to pay off my biggest debt first? SPOILER: NO.

Full help and info, including options for poorer credit scorers, in Best balance transfers.

2. Some cheap fixes have started to be pulled - so if you plan to fix soon, ASAP is safer. A fix gives you peace of mind that the rate won't change for a set time. Currently a host of 1yr fixes hugely undercut the Price Cap. Yet world turmoil has hit oil prices, and there's potential knock-on to energy prices, so we've already seen three of last week's cheapest fixes pulled and replaced with more expensive ones. So for the short term, the mood music seems to say fixing ASAP is the safest route. The MSE energy team have prepared this up-to-date table for you...

| | |

|---|---|

| | |

| Full details in our energy comparison, which also includes non-standalone tariffs - ie, those that require you to get other products, eg, broadband or boiler cover, to get the price. |

Q. These savings are only compared with the current Price Cap... what about once it ends? Each Cap lasts three months. Analysts currently predict the Jan cap will be roughly the same as now, then it'll come down slightly in April and July. Overall, if those predictions are correct, on average the Cap over the next 12mths will be almost the same as it is now, so far more costly than a cheap fix. Though the further out you go, the more crystal-ball gazing it is.

| No-fee 0%:

| Cheapest for £7,500 to £15,000:

|

|---|

| |

|---|

| |

|---|

I've told this a good few times before, but it bears repeating. Three women once came up to me after a talk, all in their 40s to 50s. They weren't together, but one after another, each told me they'd recently lost their husbands and were desperate: "I'm in dire straits, where do I start?"

I've told this a good few times before, but it bears repeating. Three women once came up to me after a talk, all in their 40s to 50s. They weren't together, but one after another, each told me they'd recently lost their husbands and were desperate: "I'm in dire straits, where do I start?"