Ho, ho, oh no!

It's 100 days till Chr******

12 need-do-nows, incl get £300+ free cash

It's about early preparation not early celebration

It's with trepidation that I mention the C-word this early, after all, the creep of playing festive Slade and Mariah Carey in October annoys me as much as the next Scrooge. Yet this isn't about early celebration, but preparation - and in these straitened times for many, that's worth doing now, to reduce the financial and personal stresses of the big day.

It's no coincidence that January is the biggest month people go to debt-counsellors. Ask them why and a common reply is "Christmas, of course". But Christmas, while costly, isn't unexpected - it's on 25 Dec every year, so if you haven't started the financial prep yet, it's oft worth it. Indeed, some fervent MoneySavers will already have got everything done.

So as it's this weekend the calendar ticks down to 100 days to go, I've a checklist for you of my 12 pre-saves of Christmas (many also work for those, like me, celebrating Chanukah or owt else). And there are far more in our 48 Christmas cost-cutters. Only ONE bank left that'll put a FREE £175 in your account in time for Christmas - but for how long? A few weeks ago, four banks were lobbing out free cash to newbies switching to their accounts. Yesterday another pulled, leaving just one. I hope some deals will return, but currently don't know of any fee-free accounts planning to. Luckily the one left is one of the best.

- First Direct, top service, free £175, 7% linked saver. Within 28 days of the switch, First Direct* pays newbies £175. You do have to pay in £1,000+, though you can withdraw that straightaway. So as switching takes 7 working days, do it today and you should have the money in your account towards the end of October at the latest. Plenty of time to put it towards your Christmas coffers.

The account's other perks include a 7% regular saver you can put up to £300 a month in, many get an ongoing £250 0% overdraft, and its debit card gives perfect rates abroad. Full info, including who counts as a new customer, in Best bank accounts.

Don't plan a perfect Christmas, do a budget now and then work out the best Christmas you can have. Many have a festive lust-list of what'd be a perfect Christmas, but that can be a dangerous mindset that may lead to debt or disappointment. Instead, let the finances lead. Spend a little time now to budget how much you can afford to spend on Christmas that won't be painful. Then start to plan how to have the best possible time on that amount.

Don't plan a perfect Christmas, do a budget now and then work out the best Christmas you can have. Many have a festive lust-list of what'd be a perfect Christmas, but that can be a dangerous mindset that may lead to debt or disappointment. Instead, let the finances lead. Spend a little time now to budget how much you can afford to spend on Christmas that won't be painful. Then start to plan how to have the best possible time on that amount.

Bigger spenders only. FREE £115 at Amazon or £150 at Sainsbury's in time for Christmas PLUS £10/month Deliveroo cashback & four airport lounge passes. Another Yuletide purse-boost here, which you can use as well as the free bank cash. Newbies signing up to the Amex Preferred Rewards Gold credit card get:

- Enough pts for a £115 Amazon/M&S gift card or £150 at Sains. The card gives 1 reward point per £1 spent, plus 20,000 bonus pts if you spend £3,000+ within the first 3mths. While hefty, that's doable for many in the Christmas run-up, if you put all normal family spending on it (though it's not an excuse to overspend). Hit that and you've 23,000 pts, enough for £115 of Amazon, M&S etc (or via a trick, convert into Nectar pts, worth £150 at Sains).

- Deliveroo and airport lounge passes. You also get 2 x £5 Deliveroo cashbacks a month (worth up to £120/year) and four free airport lounge passes a year (usually worth over £50 each).

Warning: The card is fee-free in year one, but £160 a year after, so diarise to cancel before year two if you don't want to pay. Plus, as it's a credit card, strictly only do this if you'll repay IN FULL each month (preferably by direct debit). If not, it charges 30.7% rep APR (excluding the fee), which defeats the gain. Full help, eligibility info and more options in Credit card rewards.

It's the perfect time to discuss with friends and family whether you're BANNING unnecessary Christmas presents. I've been campaigning on this for years. We spend far too much money, time, effort and stress buying people things they don't want or need in a tit-for-tat (tat being the operative word) Christmas giving extravaganza, where lots of stuff just ends up in landfill.

Don't worry: this isn't about gifts under the tree for kids or spouses. It's about agreeing with the ever-extending list of friends, colleagues, classmates and family to release each other from the obligation of buying, or just do a secret Santa or agree to donate to charity. Read the full theory in my Ban unnecessary Christmas gifts blog or watch the latest version of my viral video on it (17+ million views, 300,000+ shares - proving this isn't a niche idea)...

Get an instant up-to 6% BOOST on your Christmas supermarket spending. Supermarket saving stamp schemes (or their digital equivalents) aim to encourage year-long saving for Christmas. Yet the way they're structured means there's a loophole that lets you get a year's bonus in a day.

Get an instant up-to 6% BOOST on your Christmas supermarket spending. Supermarket saving stamp schemes (or their digital equivalents) aim to encourage year-long saving for Christmas. Yet the way they're structured means there's a loophole that lets you get a year's bonus in a day.

Just dunk what you'll spend into most schemes the day before their 'bonus day' and they add the bonus anyway. Of course this must all then be spent in that store, so it's only a winner if that's what you'd do anyway. Full info on what each supermarket pays and when their bonus days are in Supermarket Christmas boost.

Not put money aside yet? Do it now - so you can split the cost by four. Some reports have a typical family's Christmas spend at over £800. For most, that's totally unsustainable from just December's income. If you haven't put owt aside yet, there's still time - you could try to squeeze a quarter of what's needed from your Sept, Oct and Nov income. Put it in a top savings account and you'll earn a little interest too.

And if you're shouting at my text saying, "yeah right, like I can afford to save anything" - it's worth listening to yourself. Consider taking a deep breath and planning to go spending cold-turkey (sorry) this year; Christmas is just one day, don't cause yourself a huge financial hangover in the New Year because of it.

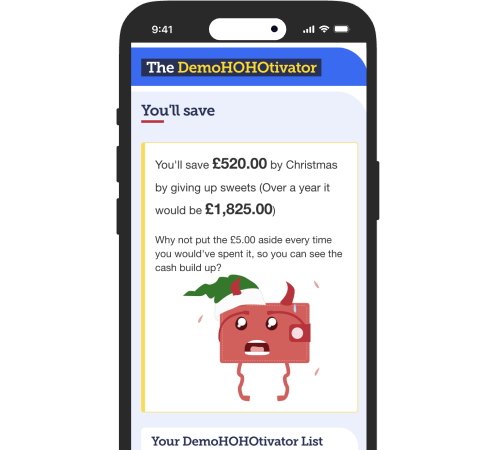

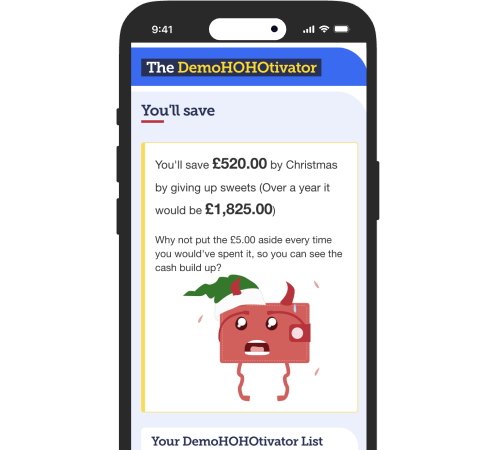

Try to DemoHOHOtivate yourself...

Small sacrifices now may add up in time for Christmas. For example if you stopped buying a £2.50 coffee every working day (and perhaps took a flask) you'd have an extra £190 by Christmas. Try our DemoHOHOtivator tool, which lets you see how all YOUR little cuts add up.

Small sacrifices now may add up in time for Christmas. For example if you stopped buying a £2.50 coffee every working day (and perhaps took a flask) you'd have an extra £190 by Christmas. Try our DemoHOHOtivator tool, which lets you see how all YOUR little cuts add up.

Walk around your home to look for owt you've not used since last Christmas. Shops don't just look at what's in their tills, they value their stock too. So should we - it's a good moment to do a personal stock check... and see if you can free up cash to spend. If you've toys, prams, old coffee makers, mobile phones, gadgets or even clothes, unused since the last festive season, ask yourself if you should flog them for cash. We've some key guides to help:

- eBay selling tips - best for pricey stuff, eg, designer or electronics

- Facebook selling tips - best for larger items, eg, wardrobes or sofas

- Vinted selling tips - best for clothes

- Flog your rubbish for cash (even old loo rolls) - tips on selling perfume bottles, jam jars and more

How to get up to 5% off your pre-Christmas shop and spend. Spend on a cashback card and it pays you back each time you spend on it (if you're already doing the Amex card above, you'll want to prioritise spending there first). - Earn 1% cashback from Chase (easy to get). You can grab the Chase* debit card via its app, without needing to switch banks, and without a hard credit-check (it just does an ID check). It pays at least a year's 1% cashback (up to £15/mth) on almost all normal daily debit card spending, and it's paid out almost as soon as you spend (you just need to transfer it to your main account). The debit card is a top pick for spending abroad too. See full Chase review.

- Earn 5% cashback for three months. The fee-free Amex Everyday credit card pays Amex newbies 5% cashback (max £100) for the first 3mths, and up to 1% after - so if you're planning a big spend soon, apply now so you get the bigger amount. However, the cashback's only paid after a year and only if you spend over £3,000+/yr on the card. If you won't hit that, don't do it. Plus, as it's a credit card, strictly only do this if you'll repay IN FULL each month (preferably by direct debit). If not it charges 30.7% rep APR, which defeats the gain. More info and options in Top cashback credit cards.

Crank up Christmas by coupling card cashback with core cashback for a cracking combination

I think I've spent my entire year's alliteration allowance on that title. If you're spending this festive season and beyond, there are other forms of cashback you can use on top of the card cashback, so you get both.

- Cashback sites: Got to a store via one of these sites and they give you a cut of what they get paid by stores for generating leads. So find the cheapest deal then go via one of these sites to get a cut back. See Top cashback sites for pros and cons.

- Add on mobile rewards: The easy, free Airtime Rewards app tracks your spending at 100+ retailers and pays 1% to 15% cashback, which you can redeem as credit on your mobile bill (for O2, EE, Vodafone, Three & Giffgaff). You CAN use this alongside other cashback sites and cards for a treble win.

Beware gift vouchers/cards. They look nice, and for some reason, offend our British sensibilities less than giving cash, but... if the store goes bust, gift vouchers usually become worthless. Plus some have expiry dates. So think carefully about the likely financial strength of the firm, and how quickly they'll be used, before you do it. If in doubt, cash (or money in the bank) is the ultimate gift voucher - it's totally flexible and can be used anywhere.

Set up a Christmas cupboard, then POUNCE when things are cheapest. Prices fluctuate (just look at online Amazon price tracker CamelCamelCamel) - so your aim, wherever you shop, should be to create a list of things needed for Christmas and buy when they're cheapest. Some even have a cupboard ready, so when they buy, they can wrap it, tag it and store it. So some quick tips for keeping on top of prices:

- Monitor this email and the daily updated MSE Deals page, where from Nov we'll include the famous Christmas Deals Predictor.

- Use PriceRunner and Google Shopping price comparisons.

- Tell PriceSpy what you want and what price you're willing to pay, and it'll email you when that item drops to that price.

- Always check the min spend for free delivery. If you're just below it, it can be cheaper to add a small extra item than pay for delivery. The Amazon free delivery tool finds it for you for the e-giant (see our 30+ Amazon tricks for more).

Train-ing home for Christmas? Get ready to book. Train tickets are usually released 10 to 12 weeks before the date of travel, and that is the best chance of getting hold of the cheapest advance tickets. So if you know you're going, in a couple of weeks be ready to book. More help in Cheap train ticket tricks.

DON'T borrow for Christmas... but if you will (don't) then ensure it's at 0%. Borrowing for Christmas is a bad idea - DON'T DO IT. Far better to cut your cloth accordingly. Yet if you'll do it anyway or feel you've no choice (DON'T), at least try to keep it cheap. There are two options where, done right, you can do it at no additional cost:

a) A 0% card. To find a 0% card you'll be accepted for, use our 0% Spending Card Eligibility Calculator - the two longest deals currently are Barclaycard's up to 22mths 0% card and the longest definite (non 'up to') deal, M&S Bank's 18mths 0% card. If you do this, always stick to the credit limit and never miss a minimum monthly repayment or you can lose the 0% rate. Normally with 0% cards, I'd say plan to clear the debt or do a balance transfer before the 0% ends - or the rate jumps to the rep APR (24.9% or 23.9% here), but for Christmas borrowing, try to clear it well before next Christmas. If you can't do that, you shouldn't be borrowing - it'll just compound your problems (or better still, don't do it).

b) Buy now, pay later. This ubiquitous option is where you can spread the cost over 3mths at no interest. It doesn't feel like a debt, but it is, though unlike credit cards, sadly safety regulation still hasn't been brought in.

Yet it can be an easy option for some, just don't do it willy-nilly - only do it if it's planned, not on a whim, and you're sure you can afford to repay within the time. If not you can still get yourself in trouble. More help in Buy now, pay later.

The hidden parental contribution for English, Scottish & Northern Irish maintenance loans - discuss ASAP. F

The hidden parental contribution for English, Scottish & Northern Irish maintenance loans - discuss ASAP. F