Martin's Savings Masterclass

UK base rate cut expected on Thursday

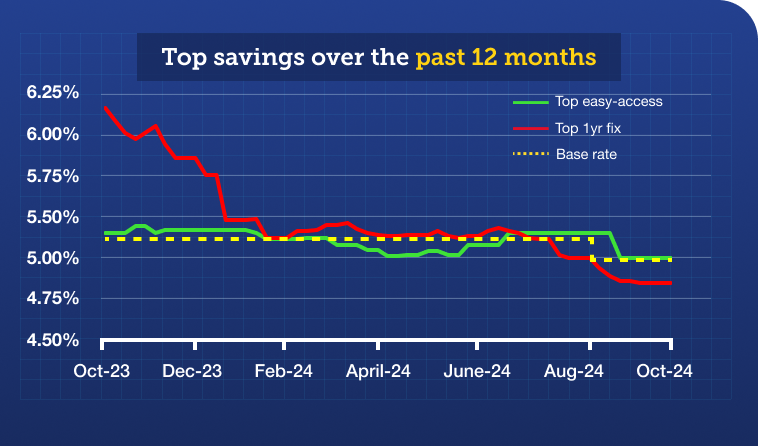

Check and boost your interest NOW. You should be earning at least around 5%

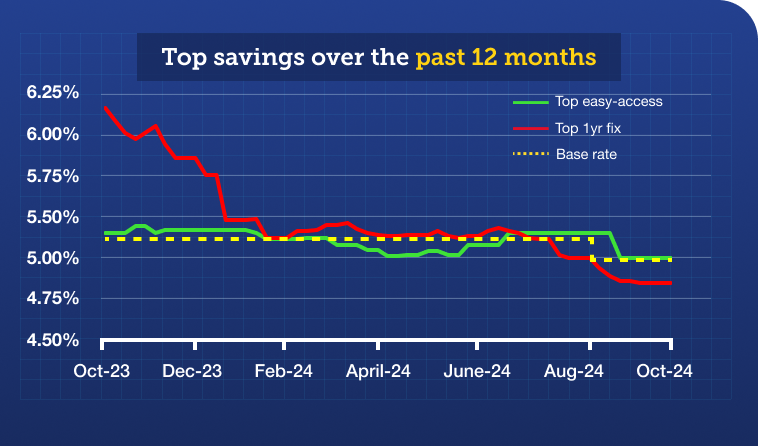

The talk is last week's Budget will raise interest rates, yet that's not quite right. Yes, they'll likely be higher than was expected, but they will still fall, just likely more slowly. Nationwide's chief economist told me that over the next 12mths it expected them to drop 1% rather than the previously predicted 1.25%.

The talk is last week's Budget will raise interest rates, yet that's not quite right. Yes, they'll likely be higher than was expected, but they will still fall, just likely more slowly. Nationwide's chief economist told me that over the next 12mths it expected them to drop 1% rather than the previously predicted 1.25%.

A cut at this Thu's Bank of England meeting is still very much on the cards... the markets imply an 80% probability (it was 95% pre-Budget) it'll drop from 5% to 4.75%. All this of course means the interest rates available to savers are set to continue to decrease. So it should serve as a reminder to everyone with savings to... 'Check your interest. Millions are on pants rates, and can easily & simply move the money to where it pays more. And if you're on a fix, diarise to act before it ends.'  OK, so now the team and I will take you through the practicals. All savings listed here have the full UK £85,000 per person savings safety protection. Got more? Spread it over multiple institutions to keep it all protected. Easy-access savings are the bog-standard, simplest form of savings, where you can put money in and take it out when you want. So the top payers here are the basic start point. Then run through the rest of the option to see if you can take it up a gear. Yet easy-access rates are variable, so they can and do move, often with Bank of England base rates, but also for banks' own competitive reasons. As rates change rapidly, do check our regularly updated top easy-access savings guide to see if things change. Top 5.17% rate is from a cash ISA. A cash ISA is just a savings account where the interest is NEVER taxed, so normally you choose it if you need the tax advantage. Yet currently two top easy-access cash ISAs beat top normal savings rates, so they're a winner for anyone (who hasn't already maxed this year's £20,000 ISA allowance).

OK, so now the team and I will take you through the practicals. All savings listed here have the full UK £85,000 per person savings safety protection. Got more? Spread it over multiple institutions to keep it all protected. Easy-access savings are the bog-standard, simplest form of savings, where you can put money in and take it out when you want. So the top payers here are the basic start point. Then run through the rest of the option to see if you can take it up a gear. Yet easy-access rates are variable, so they can and do move, often with Bank of England base rates, but also for banks' own competitive reasons. As rates change rapidly, do check our regularly updated top easy-access savings guide to see if things change. Top 5.17% rate is from a cash ISA. A cash ISA is just a savings account where the interest is NEVER taxed, so normally you choose it if you need the tax advantage. Yet currently two top easy-access cash ISAs beat top normal savings rates, so they're a winner for anyone (who hasn't already maxed this year's £20,000 ISA allowance).

- Trading 212's 5.17% AER* (min £1) allows unlimited withdrawals.

- Moneybox's 5.17% AER (min £500) limits you to three penalty-free withdrawals a year.

Both also allow you to transfer in all the money you have in previous years' cash ISAs, just apply for them and request it in the application form. It's worth noting that Trading 212's savings safety protection comes from Barclays, NatWest, or JPMorgan - see how it works.

Top normal savings easy access pays 5%. If you've used up your ISA allowance and have more to save, then the following accounts let you put large lump sums in (see top easy access for more options)...

- Chip's 5% AER (min £1), max 3 penalty-free withdrawals a year.

- Furness BS 4.9% (min £1), max 2 penalty-free withdrawals a year.

- Chetwood Bank 4.86% AER (min £1), allows one withdrawal a day, and Vanquis Bank 4.85% AER (min £1,000), allows unlimited withdrawals, are the top simple unlimited withdrawal accounts.

- Coventry BS is the top big-name account at 4.83% AER (min £1), though it only allows 3 penalty-free withdrawals a year.

Earn more if you bank with Santander. Santander Edge current account customers can earn 6% easy access on its Santander Edge saver, but only on up to £4,000 (far less than most accounts).

Earn 5.2% in a notice (variable) account. I've squeezed this in here, though it isn't easy access. Santander International* via savings platform Prosper pays 5.2% (5.02% plus a 0.18% Prosper boost), though you'll need to give 90 days' notice to withdraw, and have a minimum £20,000 to do it. It's good for larger savers who can predict when they'll need the cash. Q. What happens to easy-access rates if UK base rates drop? Most providers will likely follow suit within a few days. A few may hold on to the existing rate to get a short-term competitive advantage. So in a couple of weeks it's likely 4.7% to 4.9% will be the benchmark, so if you're near that you're good. Yet the key is to regularly monitor your rates compared to the top available as ditching & switching easy access is easy. Get £100 cashback on top of good rates (min £10,000)

Currently via this Raisin* link, newbies can use the code SAVINGS100, open a savings account and deposit £10,000+ by 30 Nov and you can get £100 automatically added (paid 28 days after opening a fix, or if it's easy access, you need keep the £10,000 in for 6mths to get it). What is Raisin? It's a savings marketplace where you can move money between the savings providers it offers with no paperwork - useful for larger savers who move money regularly. Yet your savings legally (and for savings safety rules) are with the underlying account providers, not Raisin. The savings accounts it lists are competitive. (Check against other savings here.) For example, its top easy-access rate is 4.87% and top 1yr fix is 4.85% - if you were saving £10,000 in those, the cashback is effectively like you get 1 percentage point extra interest.

With fixed-rate savings, the interest rate is guaranteed for a set time, but in return your money is locked away without access. So the benefit is certainty, especially useful when interest rates are dropping, the cost is lack of flexibility (I believe MC Hammer wrote his hit song U Can't Touch This about fixed-rate savings). At the moment, due to the expectation that interest rates will drop, you get a better rate for fixing for one year rather than longer. Top 1-year fixes: Union Bank of India UK 4.8% (min £5k), SmartSave 4.76% (min £10k), Atom Bank 4.7% (min £50), or Isbank 4.85% via savings marketplace Raisin (min £1k).

Top 2-year fixes: Market Harborough BS 4.65% (min £10k), United Trust Bank 4.62% (min £5k), Atom Bank 4.6% (min £50). All longer fixes pay less, though you can still fix above 4%, though if interest rates drop substantially, grabbing a long fix now may look good with hindsight. See top longer fixes. Q. What happens to fixed rates if the Bank of England drops UK interest rates? Existing fixes are, well, fixed, so nowt. Yet the rate you can get a new fix at is impacted. However, fixed rates are set more on the market's future rate predictions, so the fixes available now have likely somewhat factored in this week's predicted 0.25% drop, so while they may shave a little off, it probably won't be too much (in fact, the Budget may mean they hold as things are predicted to drop less quickly). Q. How does tax work on fixed rates? The interest crystalises for tax the moment you can access it (whether you do or not). For many it's irrelevant, but some near a tax bracket should go for monthly interest to spread it out over tax years, rather than risk a one-off payment pushing you up. Or if, say, you're retiring and may be a lower taxpayer in future, go for interest at maturity to delay it until then. For more, see our fixing: a taxing question help. Regular savings accounts offer higher rates on smaller amounts. They're designed for those who are putting away cash each month out of income. Most usually last one year (then you can just open one again) and some lock the money away. You can have multiple regular savers in different places, so you could save a combined £1,000+/mth in them (those with lump sums can play this by moving money out of normal savings each month into these, to earn more).

Top regular savers linked to current accounts. The top payers are perks for current account customers. Many of these bank accounts pay you to switch to them too...

- First Direct 7% FIXED for a year on £25 to £300/mth (so max £136.50/yr interest). Bank switchers can get a free £175.

- Co-op Bank 7% variable for one year on up to £250/mth (so max £114.21/yr interest). Bank switchers can get a free £75.

- Nationwide 6.5% variable for one year on up to £200/mth (so max £84.50/yr interest). Bank switchers can get a free £175.

- Lloyds Bank 6.25% fixed for a year on up to £400/mth (so max £150/yr interest). Bank switchers can get a free £200.

Those who bank with NatWest, Skipton, TSB, Yorkshire BS, Bank of Scot, Halifax, HSBC all have linked regular savers which pay 5%+. Full info in top bank regular savers.

Top regular savers open to all. Anyone can open these online (your local building society may have a decent rate too), though the amounts here are very small...

- Principality BS 8% fixed for six months on up to £200/mth (so max £27.53 interest in that time).

- Principality BS 7% fixed for a year on up to £125/mth (so max £56.58/yr interest) over the year.

- Halifax 5.5% fixed for a year on up to £250/mth (so max £82.50/yr interest) over the year. This is the highest interest possible, even if it mightn't feel it

Many 'feel' they're being conned on interest in regular savers. Yet let me assure you, for money in the account, nowt pays more. The problem is if you've £3,600 saved at the year end, some expect 7% of that as interest. But you haven't had £3,600 in for a year: you've been building it up by £300 a month. In fact, your average balance is roughly half that, £1,800, so you get around 7% of that. More in regular savings.

Bizarrely, easy-access cash ISAs currently outpay normal savings (see above). Yet there are also fixed-rate cash ISAs that pay less than their equivalents, but are worth considering. Each tax year, every UK adult gets a £20,000 allowance (in last week's Budget, we learnt this'll be frozen at this level until 2030) where you can put money away as savings (in a cash ISA) or investments (in a stocks & shares ISA) to protect it from tax. Once it's in an ISA, it stays tax-free year after year, so some who have maxed it every year now have £100,000s in ISAs. As for what ISAs are, I've used the same analogy since 2000. It works, so here it is again... Understanding ISAs is a piece of cake...

"Picture a cake, let's say a chocolate one... for cash (though it could equally be a strawberry one for shares). Normally a cake (cash savings) is unprotected, so the tax collector can come to take a bite.

"Picture a cake, let's say a chocolate one... for cash (though it could equally be a strawberry one for shares). Normally a cake (cash savings) is unprotected, so the tax collector can come to take a bite.

"Yet an ISA is a wrapper, like a piece of clingfilm you can put a certain amount of cake in. Once inside nothing changes, the cash savings are still cash savings, the only difference is... now the tax collector can't bite it because of the wrapper."

Who pays tax on savings (which ISAs can protect you from)? With normal savings, while interest is paid tax-free, it is taxable as income, yet each year you get a personal savings allowance, which means: - Basic 20% rate taxpayers don't pay tax on the first £1,000/yr of interest.

- Higher 40% rate taxpayers don't pay tax on the first £500/yr of interest.

- Top 45% rate taxpayers pay tax on all interest. As interest rates have risen in recent years, you earn over the threshold with less savings, so more people's interest is taxed, meaning that cash ISAs, even if the rates are lower, are a better bet. | Amount above which you'd pay tax on interest in top normal savings |

Top 1yr fix (4.8%) Top easy access (5%)

Basic 20% rate £20,800 £20,000

Higher 40% rate £10,400 £10,000

Top fixed-rate ISAs have a second special power. As well as never being taxable, unlike normal fixed savings, they can't lock you in - they must allow you to withdraw money, though can charge an interest penalty (say 90 or 180 days' interest) for doing so. So it's very useful if it's unlikely you need access, but want the option in an emergency. Top 1-year fixed cash ISAs: Shawbrook Bank 4.47% (min £1k), Cynergy Bank 4.46% (min £500). The top normal fix beats this at 4.8% if you don't pay tax on interest, but if you do, once you take the 20% tax off, that's only 3.84%, so cash ISAs easily win (it's 2.88% at 40% tax).

Top 2-year fixed cash ISAs: Cynergy Bank 4.3% (min £500), Shawbrook Bank 4.27% (min £1k). Again, less than the 4.65% top normal fixes if you don't pay tax on interest, but far more if you do. Already got cash ISAs? Especially older fixed rates...

If your existing cash ISA pays less than those above, you've a right to transfer it to a new top payer (all above allow transfers in). To do this, apply for the new one, and as part of the application, you'll be asked if you want to transfer your existing cash ISA over (don't just withdraw cash to move it, it then loses its 'cash ISA' status). And if you've an older fixed-rate cash ISA, you're likely locked into a terrible rate, and should pay the penalty to move. Use our Should I ditch my fixed ISA? calc to check the maths work for you.

Premium Bonds are savings, where the 'interest' each person earns is decided by a lottery. For a full explanation, see our Are Premium Bonds worth it? guide, but I'll explain super-briefly... The prize-fund rate is dropping to 4.15% (from 4.4%) for its December 2024 draw and beyond. That means £4.15 is paid out for every £100 in there, but that doesn't mean you'd get £4.15 if you had £100 in, as the smallest possible win is £25, so most with this amount get nothing. In fact, even with £1,000 in, someone with typical luck (defined as median average winnings) would win nothing. To get closer to the published amount with typical luck, you need to have more in. And even if you have the full £50,000 in, with typical luck you'll win less than 4.15% (as for each £1m winner, many must win nowt). ![A line graph titled "Expected [Premium Bond] returns over one year with average luck". It shows the relationship between the amount held in Premium Bonds and the expected annual return, and highlights that expected returns increase rapidly starting at around £1,000 held in Premium Bonds up until £2,000. After this, expected returns quickly level off at around 3.5% to 4% as the amount saved continues to rise, indicating diminishing marginal returns on larger balances. Graph links to our full guide on Premium Bonds.](https://emailtuna.com/images/newsletter/76a/76adc8f7b19cf2f0decd6f6f57927550.png) Even then, the 4.15% is substantially less than top normal savings and cash ISAs. However, as the payout is always tax-free, like ISAs, if you earn enough or have enough saved to pay tax on savings, and have a decent whack in, that's when it's likely a winner. Our Premium Bonds Prize Predictor Calculator shows what you're likely to earn for each amount. Of course that's done on unemotional logic, yet many enjoy the idea they may just win the £1m. But do understand that for most people with typical luck, without the tax advantages, you'd be worse off than normal savings. If you are on Universal Credit or Tax Credits, you may qualify for an unbeatable 50% Help to Save bonus - to help you build financial resilience. Here you save up to £50/mth, then after two years, you get 50% on top of the HIGHEST amount you had in. So imagine you saved £50 each month for a year, so you've £600, but then you take an amount out for an emergency, and put nowt in for the rest of the period - you still get a £300 bonus after two years. A second 50% bonus is paid after four years, calculated on the difference between the highest balance in years three and four, and the highest balance from the first two years. Currently, you need to take home £793+ a month to get it, but in last week's Budget, it was announced that from next April, eligibility will be expanded to anyone on Universal Credit earning £1+. Full details and how to apply in our Help to Save guide. There are a few specialist savings options some can take which pay more. So here's my checklist of other things to look at... 1. Are you a wannabe FIRST-TIME BUYER aged 18 to 39? There's a whopping 25% bonus possible via top Lifetime ISAs if you're buying a first home up to £450,000 (so ensure that's the max price). You can get a £1,000/yr boost if you max it. 2. Got expensive DEBT? Paying it off is often more lucrative than saving. See Should I pay debt with savings?, our Should I overpay my mortgage? guide, and use our Mortgage Overpayment Calculator. 3. Autosave apps can help you get in the savings habit. Autosaving apps use clever tech to work out what you can afford to save, then automatically move money from your bank account to their savings account, so you can easily build up savings without noticing. Yet rates often aren't high, so best use them, then when you build up savings, once every few months sweep the money into a top normal account. See our Automatic savings apps guide. 4. Prefer to INVEST? With investing, you aim for higher returns, but accept the risk you could lose some or all of your initial investment. I don't talk about it much, not because we're against it, just because it's not my, nor MSE's, area of expertise. Yet over the longer run, investing is often very much the right call (I do it personally as well as save). For an introduction, see Stocks & shares ISAs, but you'll need websites other than ours for help on what to invest in. PS: The focus today is on adult savings, but some may also want to look at our Top children's savings, Top junior ISAs and Child Trust Funds accounts.

Even then, the 4.15% is substantially less than top normal savings and cash ISAs. However, as the payout is always tax-free, like ISAs, if you earn enough or have enough saved to pay tax on savings, and have a decent whack in, that's when it's likely a winner. Our Premium Bonds Prize Predictor Calculator shows what you're likely to earn for each amount. Of course that's done on unemotional logic, yet many enjoy the idea they may just win the £1m. But do understand that for most people with typical luck, without the tax advantages, you'd be worse off than normal savings. If you are on Universal Credit or Tax Credits, you may qualify for an unbeatable 50% Help to Save bonus - to help you build financial resilience. Here you save up to £50/mth, then after two years, you get 50% on top of the HIGHEST amount you had in. So imagine you saved £50 each month for a year, so you've £600, but then you take an amount out for an emergency, and put nowt in for the rest of the period - you still get a £300 bonus after two years. A second 50% bonus is paid after four years, calculated on the difference between the highest balance in years three and four, and the highest balance from the first two years. Currently, you need to take home £793+ a month to get it, but in last week's Budget, it was announced that from next April, eligibility will be expanded to anyone on Universal Credit earning £1+. Full details and how to apply in our Help to Save guide. There are a few specialist savings options some can take which pay more. So here's my checklist of other things to look at... 1. Are you a wannabe FIRST-TIME BUYER aged 18 to 39? There's a whopping 25% bonus possible via top Lifetime ISAs if you're buying a first home up to £450,000 (so ensure that's the max price). You can get a £1,000/yr boost if you max it. 2. Got expensive DEBT? Paying it off is often more lucrative than saving. See Should I pay debt with savings?, our Should I overpay my mortgage? guide, and use our Mortgage Overpayment Calculator. 3. Autosave apps can help you get in the savings habit. Autosaving apps use clever tech to work out what you can afford to save, then automatically move money from your bank account to their savings account, so you can easily build up savings without noticing. Yet rates often aren't high, so best use them, then when you build up savings, once every few months sweep the money into a top normal account. See our Automatic savings apps guide. 4. Prefer to INVEST? With investing, you aim for higher returns, but accept the risk you could lose some or all of your initial investment. I don't talk about it much, not because we're against it, just because it's not my, nor MSE's, area of expertise. Yet over the longer run, investing is often very much the right call (I do it personally as well as save). For an introduction, see Stocks & shares ISAs, but you'll need websites other than ours for help on what to invest in. PS: The focus today is on adult savings, but some may also want to look at our Top children's savings, Top junior ISAs and Child Trust Funds accounts. ![A line graph titled "Expected [Premium Bond] returns over one year with average luck". It shows the relationship between the amount held in Premium Bonds and the expected annual return, and highlights that expected returns increase rapidly starting at around £1,000 held in Premium Bonds up until £2,000. After this, expected returns quickly level off at around 3.5% to 4% as the amount saved continues to rise, indicating diminishing marginal returns on larger balances. Graph links to our full guide on Premium Bonds.](https://emailtuna.com/images/newsletter/76a/76adc8f7b19cf2f0decd6f6f57927550.png)