don't add this fee, so you get the same near-perfect, bureaux-beating exchange rates as the banks. My 3 top-pick overseas spending cards

All give near-perfect exchange rates in every country

|

Best overall

Barclaycard Rewards

Visa CREDIT card Easier to get

Chase Mastercard*

DEBIT Mastercard

via app (no bank switch needed) Switch cash First Direct*

DEBIT Mastercard Via First Direct's current account (top rated for service)

Cashback on spending abroad? ✓ 0.25% on almost all overseas & UK spends. No

No but yes. No cashback on spending abroad, but new customers who switch bank to it get a FREE £175 (see top bank accounts below).

Can you get it without a hard credit-check? No, though our eligibility calc shows your odds of acceptance. ✓ Yes (it's a soft credit-check just for ID purposes, it doesn't impact your credit file, so most can get it). No

Interest-free SPENDING & ATM withdrawals? ✓ Yes, if paid IN FULL monthly (avoid if not, as 29% rep APR). ✓ Yes (as it's a debit card, and there's no overdraft facility). ✓ Yes (as it's a debit card, unless you go over the interest-free overdraft).

Fee-free ATM cash? (Individual ATMs may charge) ✓ Yes, up to £500/day. ✓ Yes, but less, up to £1,500/mth. ✓ Yes, up to £500/day.

Does it have Section 75 protection? ✓ Yes, full Section 75 protection. No, though it has lesser chargeback protection. No, though it has lesser chargeback protection.

| You may already have another top card, whether it's worth switching is questionable. If you've already got a specialist debit or credit card (eg, Club Lloyds, Halifax Clarity, Monzo, some Nationwide debit cards, some NatWest credit cards, some Santander cards, Starling and some Virgin Money credit cards), the above do beat them generally due to the cashback/perks, but it's marginal, so most needn't bother switching. Full options in Top overseas cards. |

Which is YOUR winner? It's quite a clear-cut choice right now...

- Willing to switch your current account? First Direct wins if you're new to it, as it pays you £175 cash to switch, is top rated for service, has a linked 7% regular savings account & many get a £250 0% overdraft. See top bank accounts below.

- Overall best card: Barclaycard, as it's a top cashback credit card abroad and a decent one in the UK, meaning you're paid to pay (provided you pay it off IN FULL each month, preferably by Direct Debit, to avoid any interest). Plus it's the only one you get Section 75 protection on, important if you make big purchases.

- Easiest to get, with no hard credit-check: Chase, as there's only a soft credit-check, not a full one, and you needn't switch bank accounts, just open it alongside your existing bank.

4. IF THEY ASK 'WANT TO PAY IN POUNDS OR EUROS?' Pay in the local currency. These days, buy things abroad or take cash out and the store or ATM will pressure you to pay in pounds. That's so they can ramp up the conversion cost and pocket extra profit. Just say non/nein/no! Full help in my Pay in pounds? video & blog.

5. JUST WANT TO TAKE CASH? Speedily compare 15+ bureaux. While the top plastic beats it, if you just want a little foreign cash in your pocket for safety before you go, or more as it helps you budget, then our TravelMoneyMax comparison tool quickly compares 15+ bureaux, factoring in all rates & costs to find your best. Eg, on Monday it showed the cheapest place for $1,000 cost £755 all in, compared to leaving it to the airport, where it'd likely be somewhere close to £900.

6. REBOOK TRICK: Is hotel or car hire cheaper than when you booked? If your booking has low-cost or free cancellation, regularly check if you can get the same for less. Try using Skyscanner*, Kayak*, Carrentals* and Trivago*. If you find it cheaper, just rebook, then cancel your original (best to do in that order, check you can actually really get that price before cancelling).

Paul emailed us his success last year: "Booked car hire direct in January 2024, collecting and returning for one week from Carcassonne Airport in August. It cost £609. Read your newsletter about rechecking and did. Beginning of August cost £248 - identical terms. Thanks for the heads-up." See step-by-step cancel & rebook hotels and cancel & rebook car hire help. 7. My most important TRAVEL INSURANCE rule...

Get it...

ASAB

As Soon As you Book

Booked & don't have it yet? Do it NOW! I say this because half of what you pay for is protection in case illness or other issues before you travel mean you can't go - though insurance must already be in place for that (see what counts as having insurance in place). As Bev replied to me on X: "My parents made the mistake of waiting until closer to the date, and mum got diagnosed with cancer and had no choice but to cancel as she needed life-saving surgery. They only got 10% back. An expensive mistake." I went through how to speedily get cheap travel insurance, even if aged 65+ or have pre-existing conditions in last week's email, so please jump there for the info.

8. GOING TO THE EU? Ensure you've a valid (free) EHIC/GHIC. 1.8m expire this year. These cards are a valuable additional to travel insurance and give access to state-run hospitals or GPs in EU countries for the same price as a local, so if they don't pay, you don't pay. Yet check your card, as almost two million expire this year. If it shows it's no longer valid you'll need a new one, now called a GHIC. It gives the same coverage as an EHIC, plus it can be used as proof of UK residency to access state-funded treatment in Montenegro, St Helena, Ascension Island and Tristan da Cunha - regions which aren't part of the EHIC/GHIC scheme. Both the EHIC and GHIC can also be used this way in Australia, Jersey, Guernsey and the Isle of Man. Yet the card should always be free. Never pay to get a GHIC. Beware shyster sites trying to charge you for 'fast tracks' or other fake nonsense. See how to safely get a free GHIC. 9. FAMILIES SIT TOGETHER FOR FREE. On BA, Virgin, Jet2 and more. A family of four could have to stump up £250+ to book seats to sit together on return flights. Yet gen up on the rules and your rights via our Airline-by-airline seating guide now, and you may be able to do it free (though even we struggle to find a way to overcome Ryanair's charges). 10. FOUR FREE AIRPORT LOUNGE PASSES: Plus a free £165 at Amazon & Sainsbury's. If you've not had an Amex card in the last two years, apply for this card and use it right by 27 May and there are serious freebies, including lounge passes for four. We covered the urgent deadline in last week's email, so see Amex Gold airport passes + £165 Amazon + Deliveroo bonus for full info. 11. KNOW YOUR FLIGHT RIGHTS BEFORE YOU GO: £100s compensation if your flight is delayed or cancelled. If you're on any flight from the UK, or any flight to the UK (but in this case it must be with a UK or EU airline) and your flight is cancelled, or delayed by over 3 hours, and it's the airline's fault (it often is), remember you're entitled to fixed compensation under the law (plus a refund/alternative flight for cancellations). Now that's in your head, if it happens, zip to our Flight delay & Flight cancellation rights guides for the full detail. Mark emailed us: "My wife, two children and I missed a connecting flight in January back from Lapland and ended up staying a night in Helsinki, missing work and school. I submitted a claim and after a couple of months they rejected it. I followed your guide and submitted a claim to the CAA, and Norwegian then agreed to pay out compensation of £1,400 (£350 each). Thanks." PS: Had a delay or cancellation in the last six years & didn't get compensation? Check the guides NOW. You may still be due. 12. ZARA, MASSIMO DUTTI OR PULL&BEAR SHOPPER? It's likely cheaper on hols... My Zara trick blog has long been a real winner for anyone going to Europe (especially Spain and Greece). 13. PARKING AT THE AIRPORT? BOOK AHEAD... even if it's on the day. Pull up at Manchester Airport without a booking tomorrow (Wed), and it'll cost you £419/wk to park there, but we found official parking today (Tue) via a comparison site from just £81/wk - in fact, even if you book online on the way to the airport it can be cheaper. Generally though, the earlier you can book, the better the price. See if you can save with our blagged comparison site discounts (bear in mind the biggest discount doesn't always mean the best price): FHR 11%-51% off* | Holiday Extras 10%-60% off* | SkyParkSecure 3%-44% off* | APH 16%-20% off*. For alternatives and need-to-knows, fly over to Cheap airport parking. 14. AVOID £7+ 'KISS & FLY'... though you may need to get your steps in. How to ditch the pesky charges for dropping people off at the airport, if you know where to go and can walk just a little bit. We've a newly-updated airport-by-airport guide.

8. GOING TO THE EU? Ensure you've a valid (free) EHIC/GHIC. 1.8m expire this year. These cards are a valuable additional to travel insurance and give access to state-run hospitals or GPs in EU countries for the same price as a local, so if they don't pay, you don't pay. Yet check your card, as almost two million expire this year. If it shows it's no longer valid you'll need a new one, now called a GHIC. It gives the same coverage as an EHIC, plus it can be used as proof of UK residency to access state-funded treatment in Montenegro, St Helena, Ascension Island and Tristan da Cunha - regions which aren't part of the EHIC/GHIC scheme. Both the EHIC and GHIC can also be used this way in Australia, Jersey, Guernsey and the Isle of Man. Yet the card should always be free. Never pay to get a GHIC. Beware shyster sites trying to charge you for 'fast tracks' or other fake nonsense. See how to safely get a free GHIC. 9. FAMILIES SIT TOGETHER FOR FREE. On BA, Virgin, Jet2 and more. A family of four could have to stump up £250+ to book seats to sit together on return flights. Yet gen up on the rules and your rights via our Airline-by-airline seating guide now, and you may be able to do it free (though even we struggle to find a way to overcome Ryanair's charges). 10. FOUR FREE AIRPORT LOUNGE PASSES: Plus a free £165 at Amazon & Sainsbury's. If you've not had an Amex card in the last two years, apply for this card and use it right by 27 May and there are serious freebies, including lounge passes for four. We covered the urgent deadline in last week's email, so see Amex Gold airport passes + £165 Amazon + Deliveroo bonus for full info. 11. KNOW YOUR FLIGHT RIGHTS BEFORE YOU GO: £100s compensation if your flight is delayed or cancelled. If you're on any flight from the UK, or any flight to the UK (but in this case it must be with a UK or EU airline) and your flight is cancelled, or delayed by over 3 hours, and it's the airline's fault (it often is), remember you're entitled to fixed compensation under the law (plus a refund/alternative flight for cancellations). Now that's in your head, if it happens, zip to our Flight delay & Flight cancellation rights guides for the full detail. Mark emailed us: "My wife, two children and I missed a connecting flight in January back from Lapland and ended up staying a night in Helsinki, missing work and school. I submitted a claim and after a couple of months they rejected it. I followed your guide and submitted a claim to the CAA, and Norwegian then agreed to pay out compensation of £1,400 (£350 each). Thanks." PS: Had a delay or cancellation in the last six years & didn't get compensation? Check the guides NOW. You may still be due. 12. ZARA, MASSIMO DUTTI OR PULL&BEAR SHOPPER? It's likely cheaper on hols... My Zara trick blog has long been a real winner for anyone going to Europe (especially Spain and Greece). 13. PARKING AT THE AIRPORT? BOOK AHEAD... even if it's on the day. Pull up at Manchester Airport without a booking tomorrow (Wed), and it'll cost you £419/wk to park there, but we found official parking today (Tue) via a comparison site from just £81/wk - in fact, even if you book online on the way to the airport it can be cheaper. Generally though, the earlier you can book, the better the price. See if you can save with our blagged comparison site discounts (bear in mind the biggest discount doesn't always mean the best price): FHR 11%-51% off* | Holiday Extras 10%-60% off* | SkyParkSecure 3%-44% off* | APH 16%-20% off*. For alternatives and need-to-knows, fly over to Cheap airport parking. 14. AVOID £7+ 'KISS & FLY'... though you may need to get your steps in. How to ditch the pesky charges for dropping people off at the airport, if you know where to go and can walk just a little bit. We've a newly-updated airport-by-airport guide.

15. DO YOU HAVE FREE EU ROAMING? Most big networks don't, many little 'uns do. Vodafone, Three and EE all now charge £2ish/day to use your home phone & data package in the EU. O2 is the only 'big four' network to still be free. Yet many piggyback operators are free to EU-roam, including Lebara, Smarty and Giffgaff. With 14m of you out of contract, free to switch and often already massively overpaying, why not ditch and switch to save in the UK and in the EU? Or you can do more specific searches via our Cheap Mobile Sim Finder. For example, currently the following all include EU roaming (and roaming in some other countries) at no extra charge: - Lebara (via Vodafone signal) - 5GB for '£2.63/mth' (includes full allowance)

- iD Mobile (via Three signal) - 40GB for '£3/mth' (max 30GB abroad)

- iD Mobile (via Three signal) - 120GB for '£5.42/mth' (max 30GB abroad) Do put a spend cap in place for when you go abroad to avoid bill shock, and use our tips for using less data. 16. ROAMING OUTSIDE THE EU. There's an eSIMple way to cut costs. Your home network will charge up to £15/day for very limited data via a costly add-on - just watching TV can cost a fortune. Instead buy cheap international eSims online (eg, £9 for 9GB USA data that lasts 30 days), which adjusts your phone's settings and temporarily routes it via another provider so it provides your data allowance overseas. Prices differ based on your destination and the length of your trip, so as with most purchases, it's wise to compare a few providers to find the best eSim for your needs. Popular providers to try: Airalo* | Breeze* | EasySim* | Firsty* | GoMoWorld | Holafly | Nomad | Saily* Frustratingly, feedback on these firms is tough to come by, so we can't vouch for how good the coverage or the speeds are. Even so, don't be put off, many people rave about eSims, including me - read my story of trying an eSim from a couple of years ago (spoiler: it worked well and was far cheaper). 17. Beware holiday car hire traps

i) Booking early, via a comparison, usually wins. We saw car hire prices skyrocket after the pandemic, but in recent years they've been falling. Early booking tends to be cheapest, but we've also seen some super cheap last-minute deals in places where there's spare capacity (so try for free cancellation and check the cancel & rebook tip). Either way, don't leave it till you get there. Top comparison sites include: Kayak* | TravelSupermarket* | Carrentals* | Enjoy Travel*

See a full list and far more help & tricks in Cheap holiday car hire. ii) Be ready for the insurance hard-sell at pick-up - make sure you're pre-prepared to beat it. Car hire usually includes basic insurance. Despite this, at pick-up they'll almost always try to push you to get 'excess cover insurance' at up to £25/day with scare stories of huge bills for just a scratch (or sometimes implying you have to do it). Say no. Instead, get standalone car hire excess cover insurance. - Compare prices via the MoneyMaxim* holiday car hire excess insurance comparison.

- Then check against MSE Blagged discounts, eg, our 20% off Leisure Guard* (with code MSE20), 20% off ReduceMyExcess* and 17% off Eversure* (code will be auto-filled when you follow these links).

- If you hire cars a lot, you can buy an annual policy. iii) They WILL try to put you off doing this. Even once you've told them you've got your standalone insurance, they'll try to put you off or tell you it doesn't work. They will also normally make you jump through hoops, and find ways to exclude you from doing this. You must usually... - Leave a refundable deposit of possibly up to £1,200 on a credit card.

- Have a credit card, as often debit cards aren't accepted.

- Have the card in the name of the person who booked (though some say it needs to be the main driver). If not, they won't accept it, so check first. Don't be overly put off by these tactics. Many (including me) successfully do this with no problems. Just be prepared.

18. SORRY, BUT DO A BUDGET. Though you can factor in what you're not spending at home. Not many relish the idea of sticking to a budget while away, but if you don't you can have a holiday hangover when you get back. Even if it's just an idea of what you can afford to spend, it's useful to do a budget before you go (and be careful if you're out on the town - drinking and sticking to financial limits go together as well as Baileys and lime juice). As a salve, remember when you're away that some of your usual home expenditure won't be made (no food, lower energy bills & transport), so you can add that into your budget. For general help, see our budgeting guide. 19. HOW LONG DOES SUN CREAM LAST? Turn it around to find out. Don't just assume your old sun cream no longer offers protection and fork out for new bottles. Watch my video explainer or take a look at our turning sun cream around help.  20. BEWARE HOLIDAY SCAMS. They're rife. If you get an out-of-the-blue email or WhatsApp message offering deals, be very careful. Scams are rife - it's a Wild West out there. Any source contacting you that you haven't asked to is a risk. See our full list of holiday scams to be aware of. 21. A MICKEY MOUSE DEAL: How to cut costs at Walt Disney World. Doing the Orlando parks is never a MoneySaving trip, but if you're going, we've 34 Disney & Universal tips and tricks to help with costs, including a code to nab discounted attraction tickets, what to watch out for when booking and how to find hidden freebies.

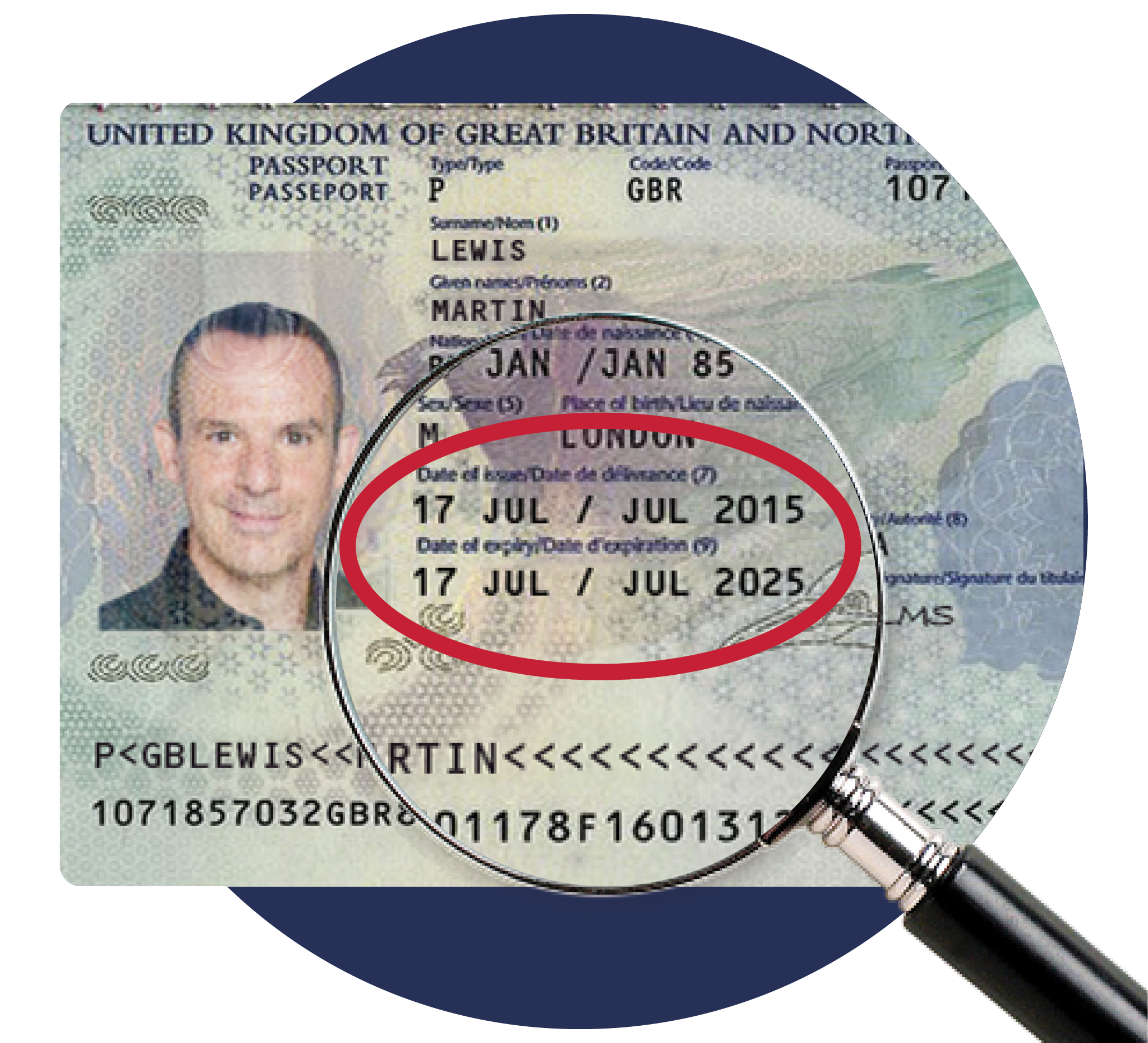

20. BEWARE HOLIDAY SCAMS. They're rife. If you get an out-of-the-blue email or WhatsApp message offering deals, be very careful. Scams are rife - it's a Wild West out there. Any source contacting you that you haven't asked to is a risk. See our full list of holiday scams to be aware of. 21. A MICKEY MOUSE DEAL: How to cut costs at Walt Disney World. Doing the Orlando parks is never a MoneySaving trip, but if you're going, we've 34 Disney & Universal tips and tricks to help with costs, including a code to nab discounted attraction tickets, what to watch out for when booking and how to find hidden freebies.  1. THE PASSPORT CHECK: Don't risk being turned away.

1. THE PASSPORT CHECK: Don't risk being turned away.  8. GOING TO THE EU? Ensure you've a valid (free) EHIC/GHIC. 1.8m expire this year.

8. GOING TO THE EU? Ensure you've a valid (free) EHIC/GHIC. 1.8m expire this year.  20. BEWARE HOLIDAY SCAMS. They're rife.

20. BEWARE HOLIDAY SCAMS. They're rife.